Acquiring

- We offer a multifunctional payment processing system which can be tailored to fit each merchant's needs, individually adjust payout frequency, and rolling reserve. Whether it's IPSP or PF services we are confident we can provide the best solution for your needs.

- We take responsibility for guiding merchants through the onboarding process, therefore decreasing costs for onboarding and monitoring from the bank.

- Technical support is available in multiple languages 24 hours a day to ensure maximum uptime.

- We supply "White Label" solutions for financial institutions, allowing control over specific features, branding, and seamless integration.

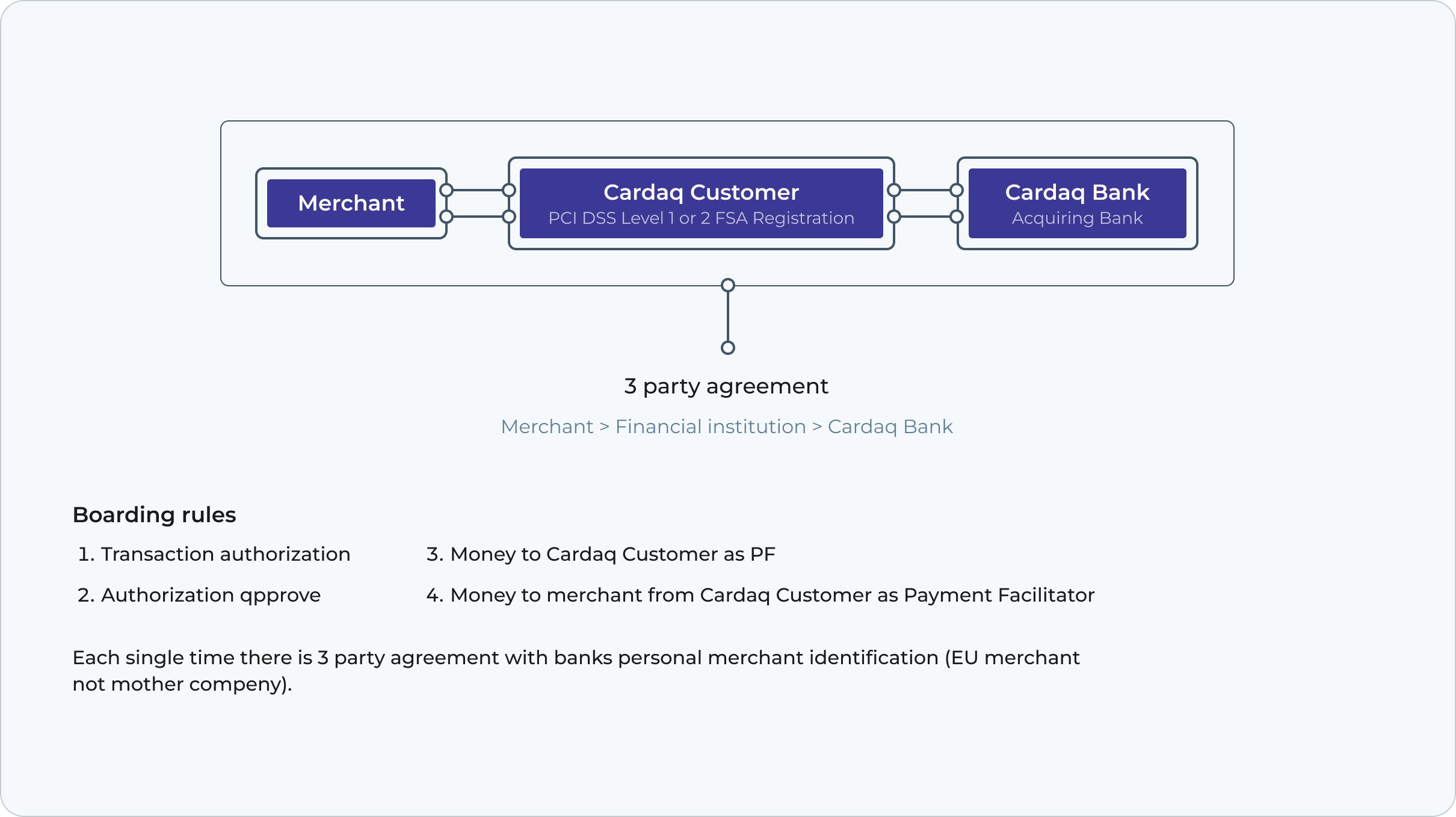

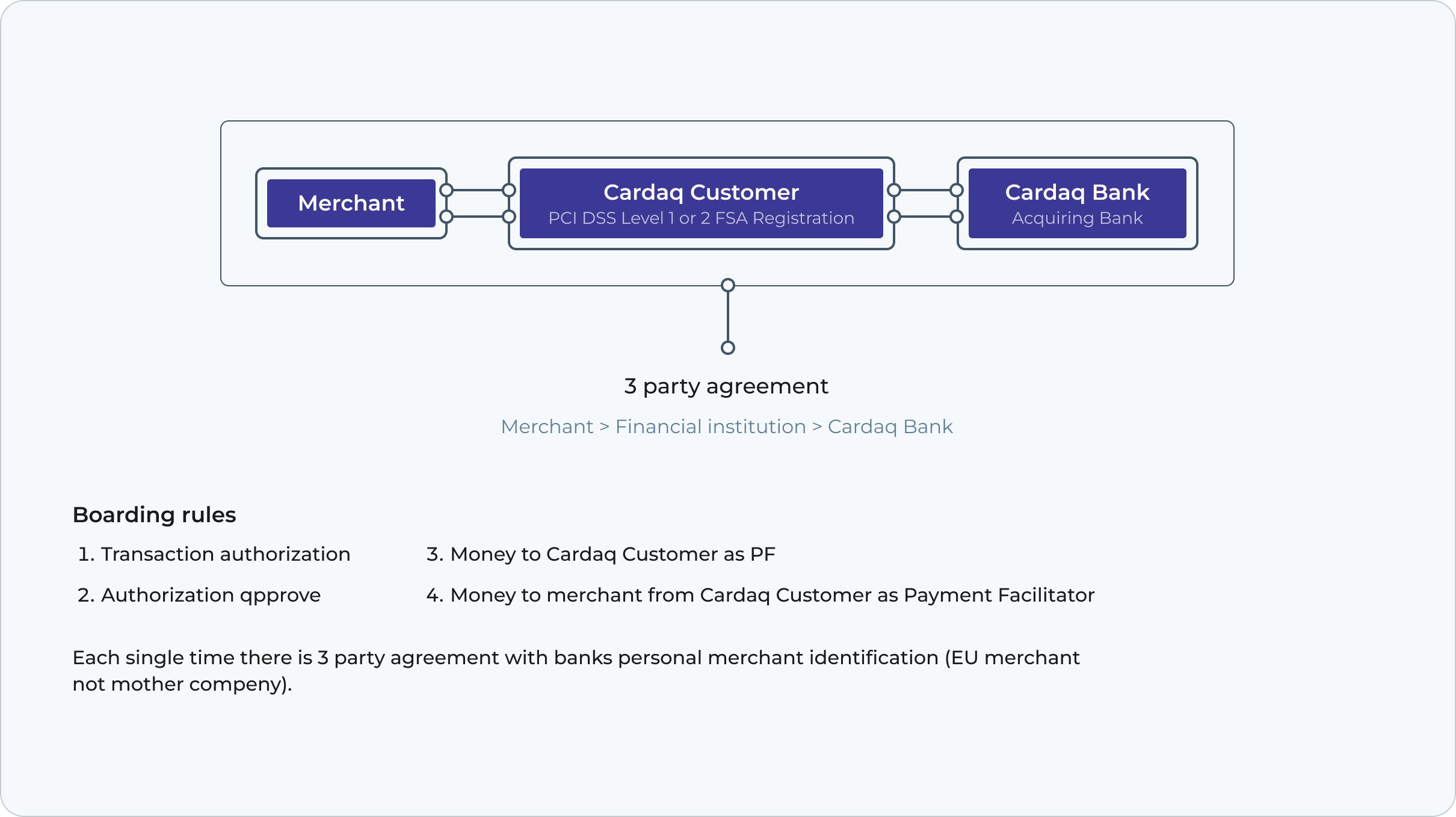

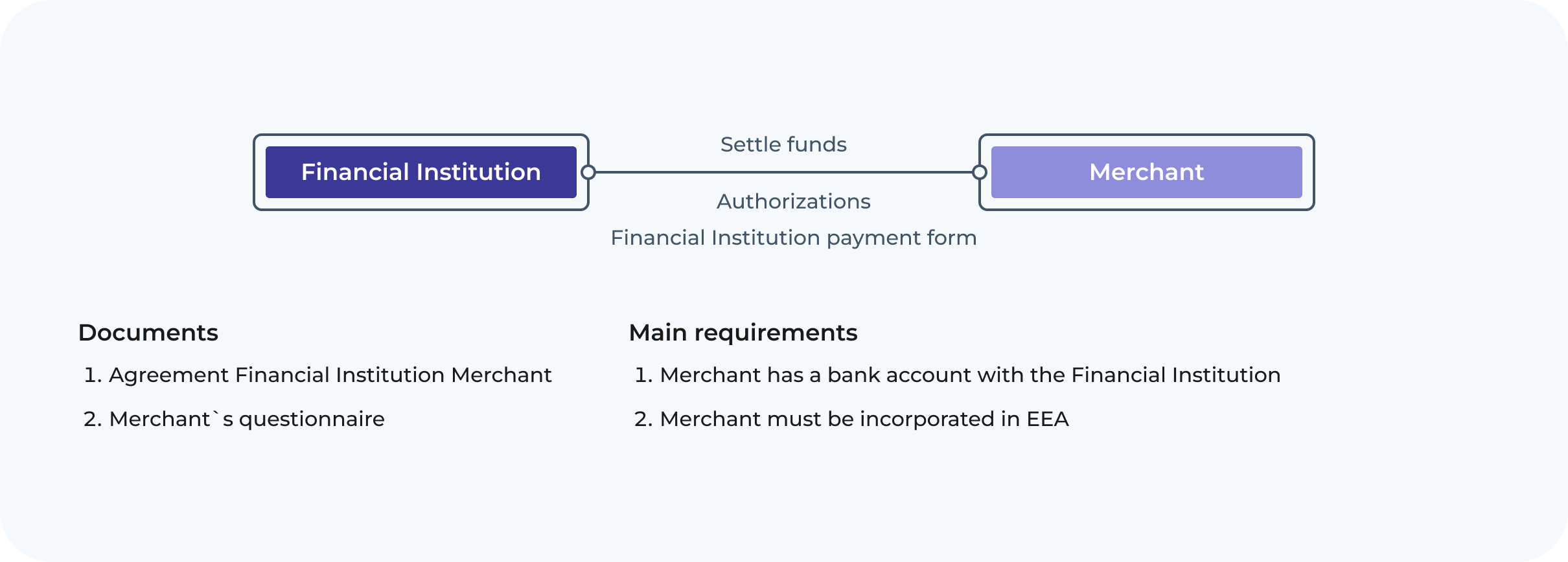

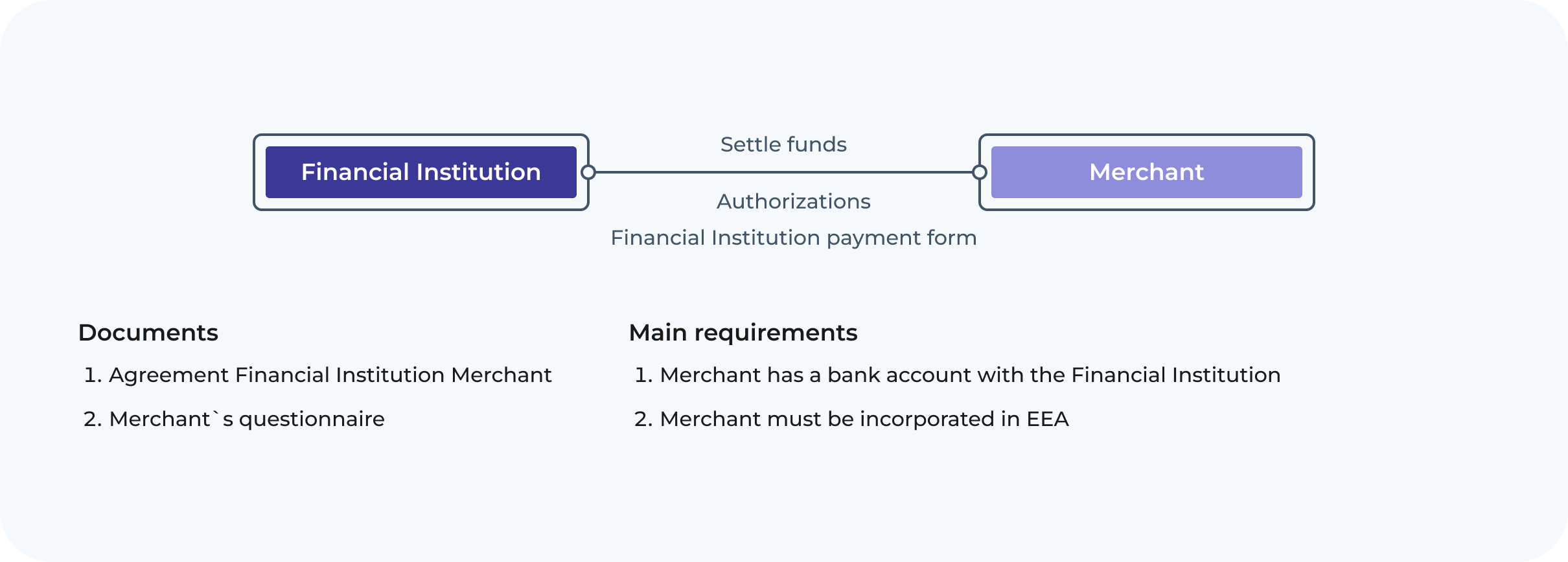

Merchant onboarding (Direct)

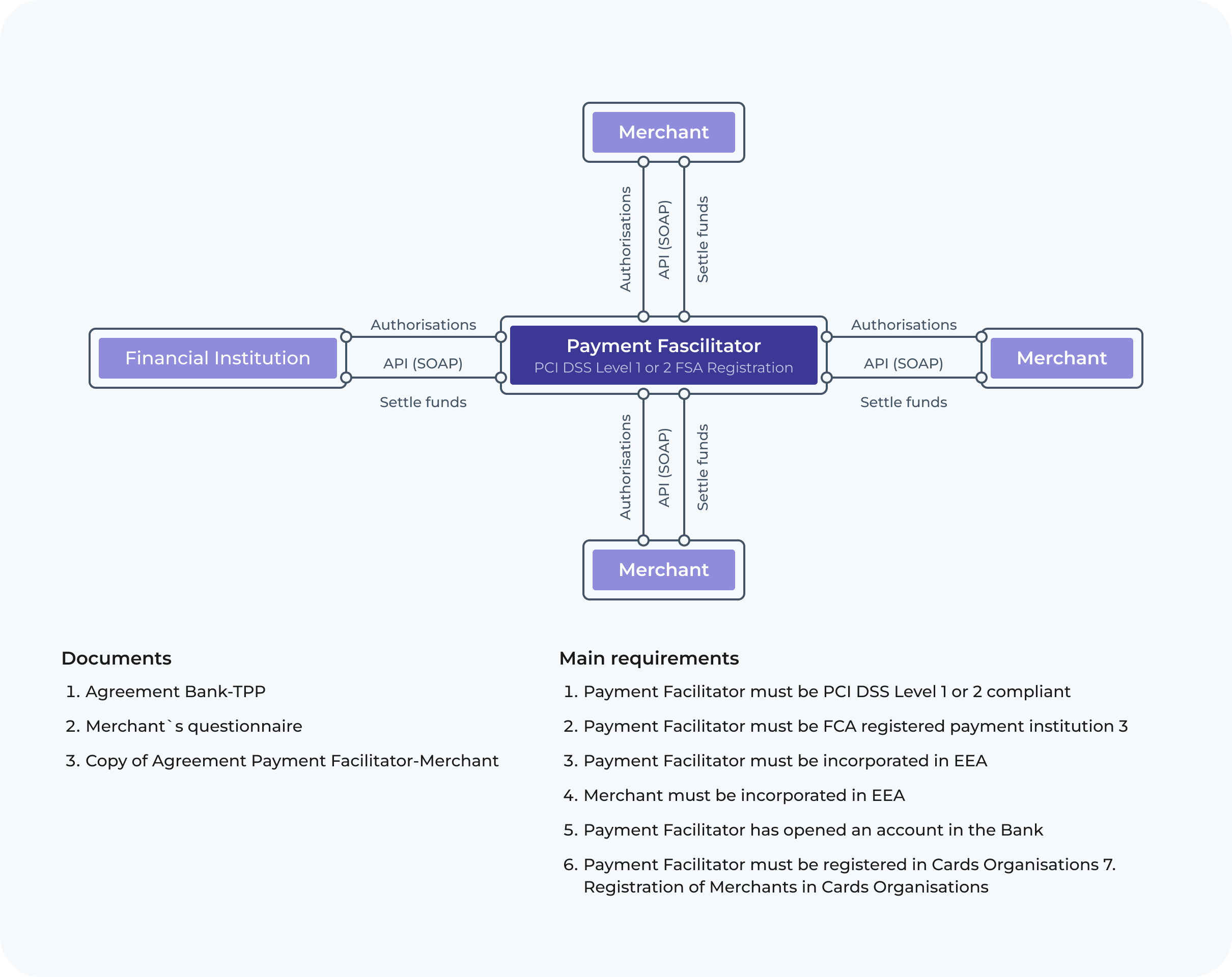

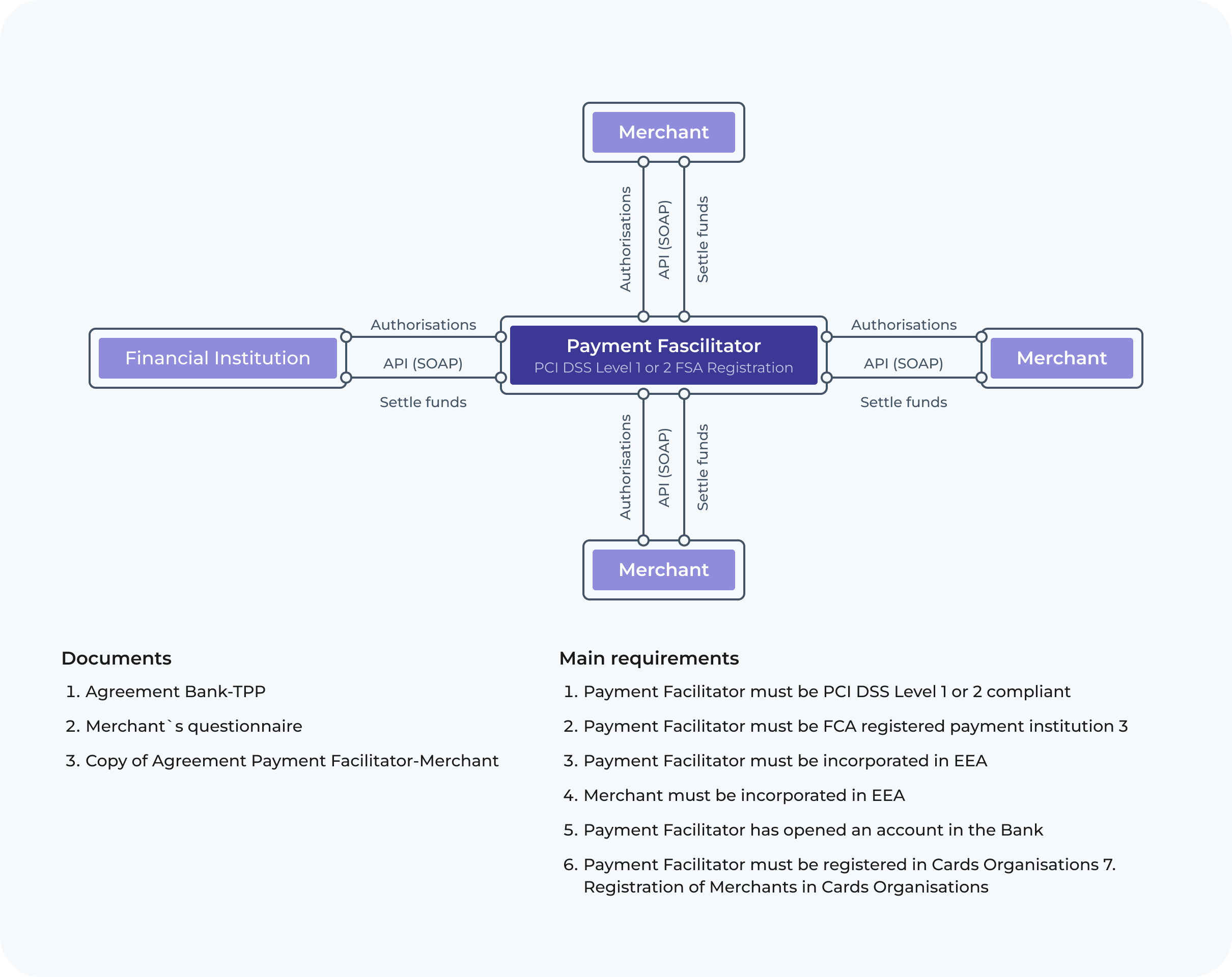

Payment Facilitator Model (Indirect)

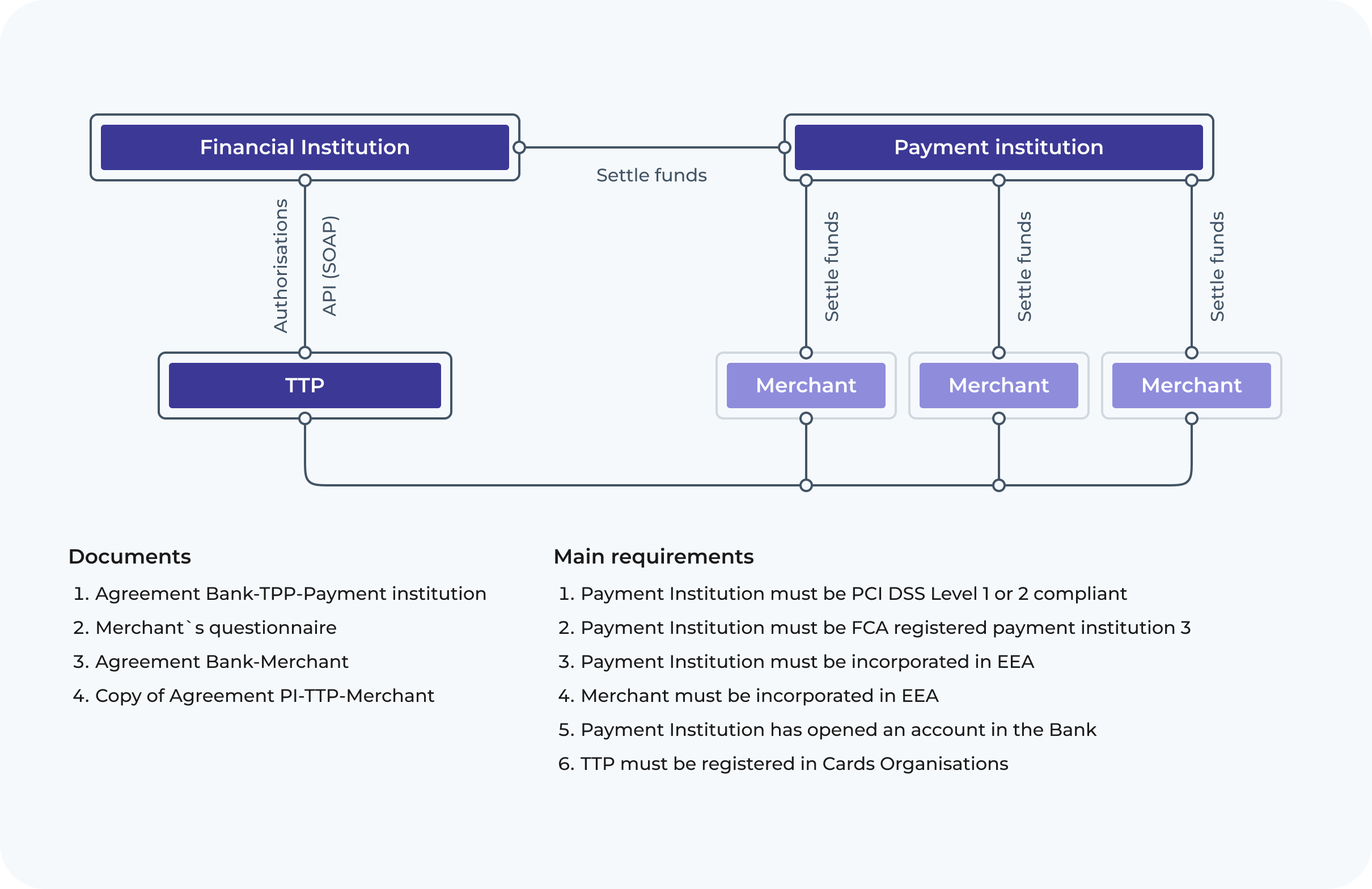

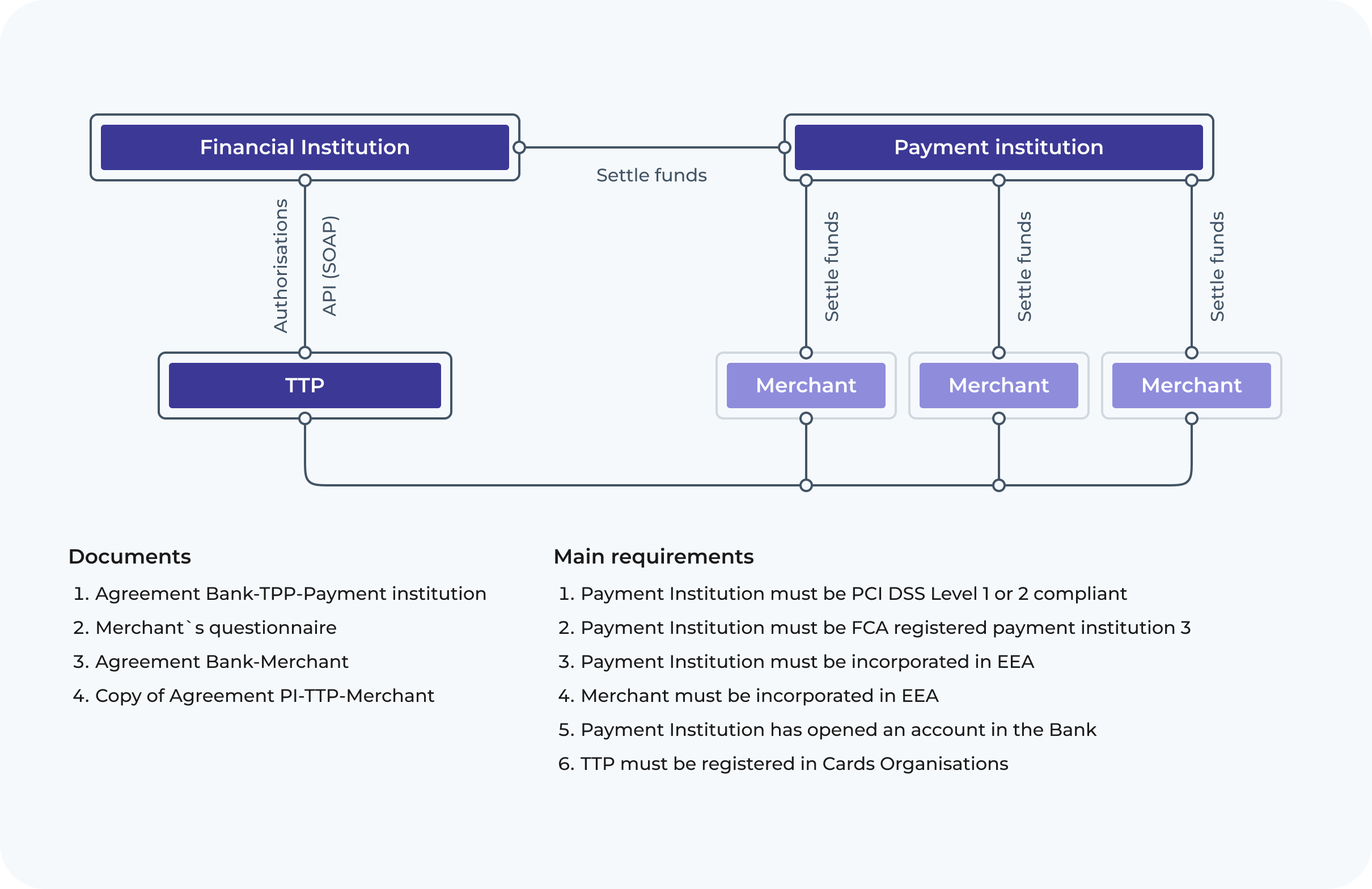

Third Party Processing Model (Indirect)

Third Party Processing Model with Direct Merchant Relationships

Our functionality:

- MasterCard processing

- Visa processing

- China UnionPay processing

- 3DS transactions

- CFT payouts

- Token payments

- Recurring payments

- Dynamic descriptor

- Partial Reversal

- Partial Deposit

- Multi-currency processing

- Multi-currency settlements

- Reversal

- PCI DSS (Payment Card Industry Data Security Standard) certified gateway

- API (SOAP- Simple Object Access Protocol)

- Payment form

Security and Protection:

- PCI DSS Level 1 Compliant

- GDPR.EU Compliant

- PSD2 Compliant

- MasterCard SecureCode

- Visa Secure

- China UnionPay Secure

- Smart 3DS

- HTTPS

- DDOS Protection

Settlement Currencies:

| Country | Currency | Code | Wire | IACH | Draft | Electronic | Cash Letters and Collections | Link Balance | Forwards (Buyer Side) | Forwards (Seller Side) | Non-Deliverable Forward | Options | Non-Deliverable Options |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

| Australia | Dollar | AUD | Yes | BECS | No | No | Yes | Yes | Yes | Yes | No | Yes | No |

Fees:

1. Low Risk

Fee type

Fee

Initial fee for consideration of the Service Provider, verification and Due Diligence procedure

0 GBP

Fee for the services of the Acquirer in acceptance of Cards (Service provider buy-rate)

in EUR, USD, GBP currencies

in other currencies

in EUR, USD, GBP currencies

in other currencies

EU cards: IC++0.3%

Must be negotiated

Non-EU cards: IC++0.3 %

Must be negotiated

Commission fee for each successful Card Payment

0.09 GBP

Commission fee for the declined transaction

0 GBP

Commission fee for each refund

0.86 GBP

Fee for the Original Credit Transactions (OCT)

N/A

Commission fee for each successful OCT

N/A

Commission fee for Chargeback or Second Chargeback (pre- arbitration) processing

12.90 GBP + Card Scheme fees

Commission fee for Chargeback Representment processing

12.90 GBP + Card Scheme fees

Arbitration

According to Card scheme fees

Commission fee for Copy Request / Retrieval Request processing

12.90 GBP + Card Scheme fees

Wire transfer fee for payout

SEPA - 2.58 GBP

non-SEPA - 25.80 GBP

Authorization Attempts decline by MID in 24h by one card

0.51 GBP per transaction

Merchant connection monthly fee (per MID)

12.90 GBP

2. Medium Risk

Fee type

Fee

Initial fee for consideration of the Service Provider, verification and Due Diligence procedure

0 GBP

Fee for the services of the Acquirer in acceptance of Cards (Service provider buy-rate)

in EUR, USD, GBP currencies

in other currencies

in EUR, USD, GBP currencies

in other currencies

EU cards: IC++1%

Must be negotiated

Non-EU cards: IC++1%

Must be negotiated

Commission fee for each successful Card Payment

0.11 GBP

Commission fee for the declined transaction

0 GBP

Commission fee for each refund

1.72 GBP

Fee for the Original Credit Transactions (OCT)

N/A

Commission fee for each successful OCT

N/A

Commission fee for Chargeback or Second Chargeback (pre- arbitration) processing

17.20 GBP + Card Scheme fees

Commission fee for Chargeback Representment processing

17.20 GBP + Card Scheme fees

Arbitration

According to Card scheme fees

Commission fee for Copy Request / Retrieval Request processing

17.20 GBP + Card Scheme fees

Wire transfer fee for payout

SEPA - 2.58 GBP

non-SEPA - 25.80 GBP

Authorization Attempts decline by MID in 24h by one card

0.51 GBP per transaction

Merchant connection monthly fee (per MID)

12.90 GBP

3. High Risk

Fee type

Fee

Initial fee for consideration of the Service Provider, verification and Due Diligence procedure

430 GBP

Fee for the services of the Acquirer in acceptance of Cards (Service provider buy-rate)

in EUR, USD, GBP currencies

in other currencies

in EUR, USD, GBP currencies

in other currencies

EU cards: IC++2%

Must be negotiated

Non-EU cards: IC++2%

Must be negotiated

Commission fee for each successful Card Payment

0.13 GBP

Commission fee for the declined transaction

0.04 GBP

Commission fee for each refund

3.87 GBP

Fee for the Original Credit Transactions (OCT)

N/A

Commission fee for each successful OCT

N/A

Commission fee for Chargeback or Second Chargeback (pre- arbitration) processing

21.50 GBP + Card Scheme fees

Commission fee for Chargeback Representment processing

21.50 GBP + Card Scheme fees

Arbitration

According to Card scheme fees

Commission fee for Copy Request / Retrieval Request processing

21.50 GBP + Card Scheme fees

Wire transfer fee for payout

SEPA - 2.58 GBP

non-SEPA - 25.80 GBP

Authorization Attempts decline by MID in 24h by one card

0.51 GBP per transaction

Merchant connection monthly fee (per MID)

12.90 GBP

High-Risk merchant registration fee (per MID)

430 GBP