Cardaq follows all rules and procedures and is registered in National Crime Agency to submit the SAR reports.

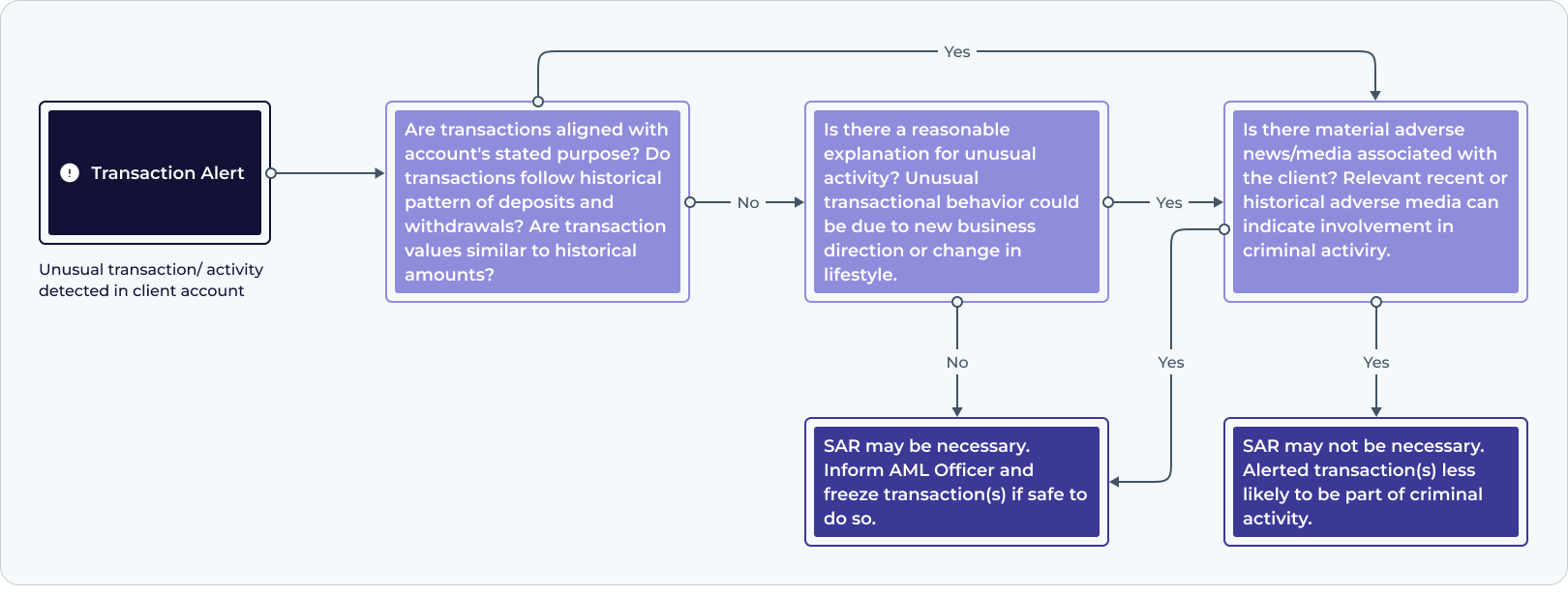

Suspicious Activity Reports Suspicious Activity Reports (SARs) alert law enforcement to potential instances of money laundering or terrorist financing.

SARs are made by financial institutions and other professionals such as solicitors, accountants and estate agents and are a vital source of intelligence not only on economic crime but on a wide range of criminal activity.

They provide information and intelligence from the private sector that would otherwise not be visible to law enforcement. SARs can also be submitted by private individuals where they have suspicion or knowledge of money laundering or terrorist financing.

Please note that based on the regulations we cannot inform our customers about submitted SAR or any other related information and update on the situation if there is any ongoing process or not. If the SAR report was submitted on you as one of the Cardaq Limited customers, please stay with us and be patiente as we will act based on our policies and procedures, legislation and instructions from the law infrocmenet authorities. Your funds would be protected during the investigation and kept on the dedicated safeguarding accounts.